Of the many benefits that come with outsourcing payroll, specialised expertise would be the most notable. By outsourcing your payroll, it provides HR with the opportunity to save on time and cost as well as navigate delicate cultural, language, and regulation issues. By engaging a third-party payroll vendor, the HR department can significantly reduce risk and labour.

Payroll outsourcing reduces cost and saves time.

Processing payroll in-house is time-consuming. It is delicate work that requires a high level of attention to detail. The stress on workload only rises as the company grows and headcount increases. It is important to remember that payroll is only a subfunction of the HR department and one which is an administrative back-end function. Unlike other strategic functions of HR that can drive business performance such as management of employee benefits, recruitment, and training. Consider the benefits to the business if your HR teams were wholly focussed on these instead of scrutinising considerable amounts of data to avoid miscalculations and errors. It is important to note that the time your department saves by not burdening itself with this duty is reflected in cost savings. So, by outsourcing payroll processing, which includes anything from calculating payroll taxes and statutory filings to handling payroll enquiries and disbursement, you benefit your organisation financially too!

The ongoing costs of the payroll software, additional headcount required for processing wages, managing paperwork, and tax liabilities can add-up to a considerable sum. So, in addition to saving time-cost, by choosing to outsource your payroll functions to a payroll vendor, you could be generating concrete savings to your bottom line.

All things considered, the actual extent to which payroll outsourcing will assist in reducing your costs depends on your current level of efficiency in administering payroll in-house and of course, the complexity of your payroll.

Payroll service providers can offer you peace-of-mind when it comes to compliance and data security.

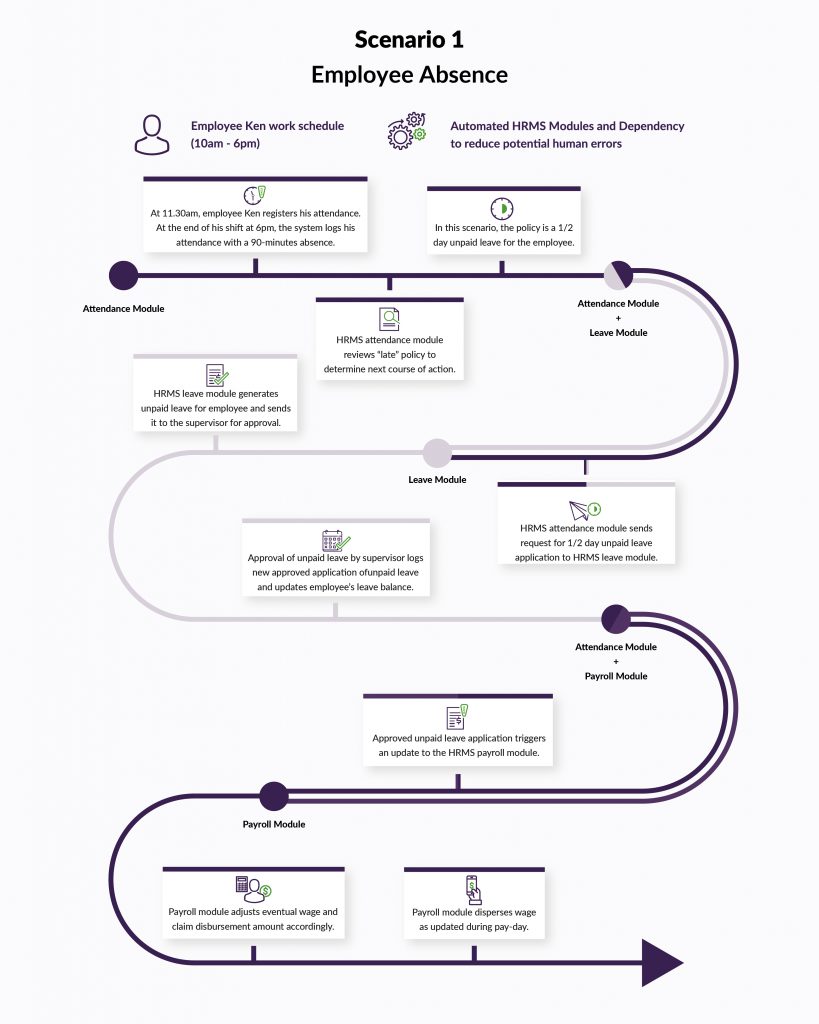

Staying up-to-date with complicated compliance regulations is an ever-present and real risk that HR teams face when running payroll operations in-house. Even with the most experienced employees, lapses may occur when your department gets busy. Payroll vendors minimise this risk through a dedicated team of experts that operate under stringent protocols and multi-level cross-checking – a process that is often skipped when managing in-house to save on time.

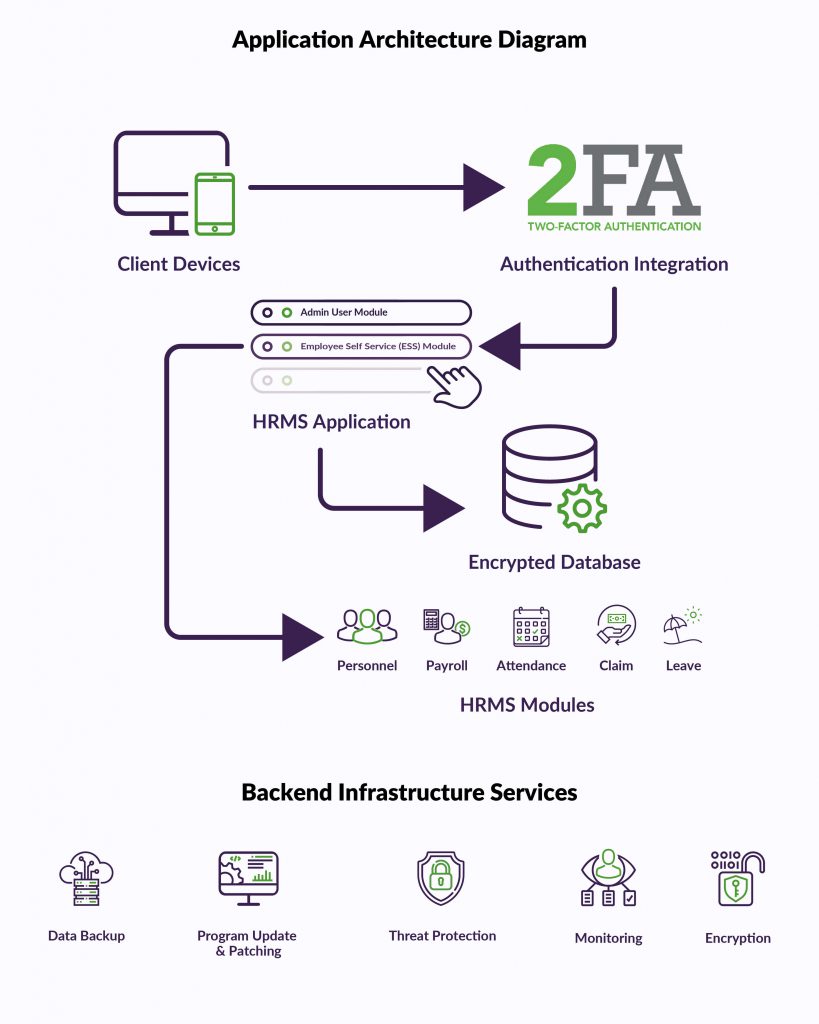

Another aspect for worry other than compliance would be security. Considered the security of your HR payroll software and data is In an age when data security and personal data protection are at the forefront of conversations it is critical you have the appropriate measures in place to ensure accountability with these matters. You need to consider where your payroll software and data are stored and is this a secure location with ISO certification? Do you have the latest security updates installed and processes in place? In the event of an unfortunate lapse in security or hardware malfunction, the many hours required to recover your data along with the implication of experiencing an extremely sensitive data breach will deal a severe blow to the HR department and your company.

By contrast, when you outsource your payroll to a top payroll outsourcing company, they will offer highly secure payroll solutions. They do this by storing your data on highly secure cloud-based servers that utilise state-of-the-art encryptions that prevent any unauthorised access. Data-loss worries would also be a thing of the past with backups across multiple server locations. This essentially allows the HR department to eliminate the effort and time cost that comes with constant security monitoring and data protection—in short, peace-of-mind with minimal effort.